Q4 2024

DEBT COMING FOR 60/40 – 2022 REPEAT IN 2025?

Markets are showing signs of extreme optimism at their highs. Post the US election, not only have asset prices continued to march higher, but experienced a major positive shift in sentiment, as if everything suddenly became better! Consumer surveys, investor allocations, c-suite expectations all experienced increases. This matters because spectacular returns with low volatility can absolutely encourage risk taking when extrapolated into the future.

A 2022 repeat could be in the cards for the 60/40. First, it is fundamentally difficult to like bonds. Inflation is above target and trending higher. Monetary policy is loosening. Fiscal policy remains extremely stimulative. Realized volatility in rates remains elevated. Issuance in 2025 will be ~10 trillion. Second, equity valuations are elevated in comparison to historical levels and a continued push higher in rates could cause multiple compression. Positive correlations between the “60” and the “40” should be expected.

Please join us in this quarterly update for an in-depth discussion on how awesome the last 2-years have been for risk assets, how rates can wreak havoc on your portfolio, and Convexitas firm updates.

Market commentary

The global risk-on rally continued for the 9th straight quarter in Q4 2024. Since the September 2022 rates scare (largely driven by UK), global risk assets have been on a march higher. Spectacular returns post a market pullback are not exactly unique, but the lack of volatility during the recovery is uncommon. Over the past 2-years, S&P500 has generated ~58% total return on a monthly realized volatility of ~12.

Utilizing SPX data since 1927, a rolling 24-month ratio of returns / realized volatility highlights how impressive recent returns have been. The big spikes above current levels were in 1937, 1955, and 1996. Those are the only periods over the last 100-years with significantly better risk-adjusted returns. Maybe we are in a similar environment to 1996 when the Fed generated a soft landing, and corporations started to commercialize the internet. However, even with those parallels to the current soft landing and AI commercialization, it is important to level-set future expectations rather than simply extrapolate the recent past.

Fundamental Problems with Bonds

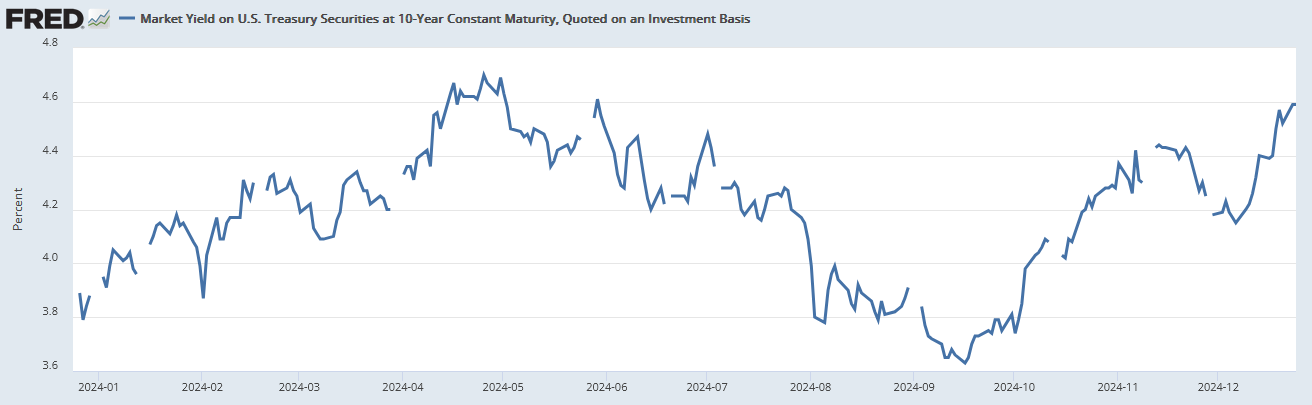

In September the FOMC started the current rate cutting cycle with a rare non-recessionary 50bps cut in the federal funds rate. In the past two meetings, they followed through with two additional cuts bringing the total to 100bps. Longer-dated treasuries have responded to these cuts negatively, selling off (higher yields) by ~100bps. Is the Fed losing control? Are bond vigilantes winning? Or is it as simple as the fair price for the Treasury to borrow over the long-term rose on fundamental factors?

Source: https://fred.stlouisfed.org/series/DGS10

The market may demand higher compensation for many reasons:

- Inflation remains above 2% target and has been trending higher.

- Monetary policy is loosening into above target inflation.

- Fiscal policy remains extremely stimulative.

- Realized volatility in rates remains elevated.

- Taxable investors have been sopping up supply, and after-tax returns are what should matter to these investors.

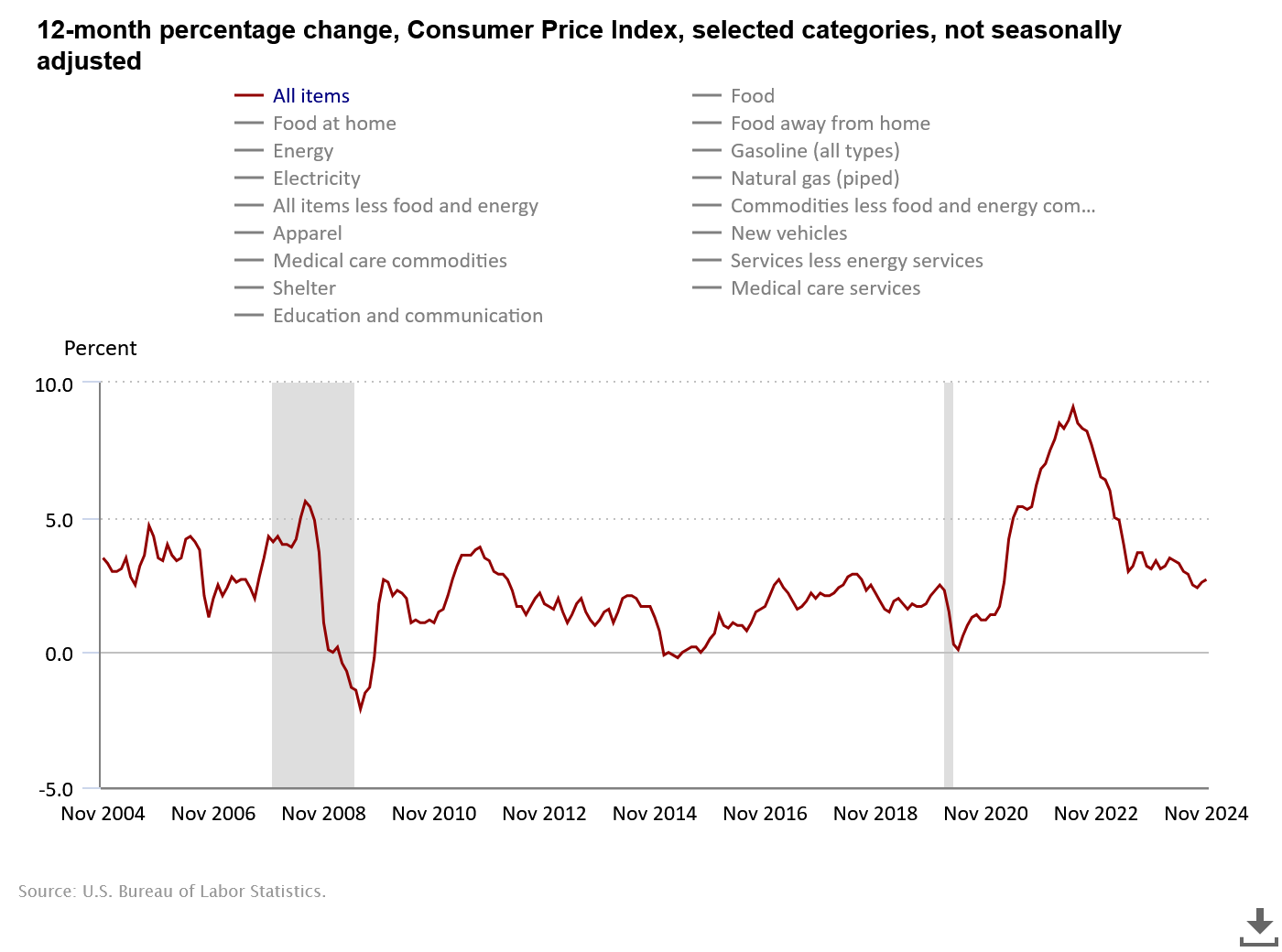

Markets, politicians, and Fed governors have been celebrating the decline in the rate of inflation since 2022. Much of the narrative has been “mission accomplished”. The stated long-term inflation target by the Fed has remained 2%, and yet, monetary policy has been loosening before achieving that level. Worse yet, monthly CPI / PCE / Core have started to tick back up towards 3%. The data is messy and there is no reason to hang onto tenths of a percent. Nevertheless, it is difficult for an investor to anchor onto the 2% target when we have not seen that level since Covid and inflation is trending higher.

Acceleration matters more than velocity: shifts in the pace of change in policy is generally more important than the pace itself. This is why markets tend to focus on inflection points. Fed Funds are significantly higher than at the start of the hiking cycle (4.25-4.5% currently) and the Fed continues to taper its balance sheet. What is more important than this velocity of policy is the acceleration of recent actions. The FOMC has slowed the pace of tapering and has cut rates 100bps. Financial conditions have since eased significantly with the rise in the stock market, continued tightening of credit spreads, a decline in volatility, increased inflation and growth expectations, and strengthening of the dollar. These monetary policy actions make investing in treasuries less appealing.

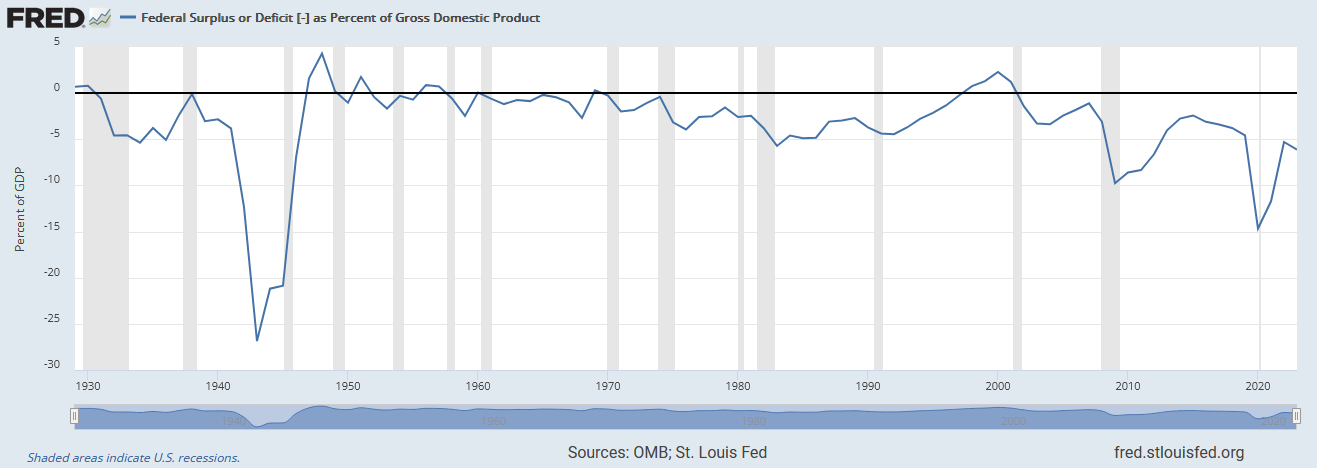

Source: https://fred.stlouisfed.org/series/FYFSGDA188S

Spending is the one thing all politicians can agree on! The world is now years away from the last crisis. Growth has been strong. The unemployment rate has remained low. Consumer spending continues to set new highs. Corporate earnings are at all-time highs. Yet with this list of positive economic factors (which could be much longer), the federal deficit is running at levels you would expect for a recessionary period. Fiscal policy remains very stimulative, and the large deficits are increasing the future supply of treasuries. The ever-expanding debt/GDP with limited proof of action to address the continued supply of treasuries should cause investors to demand additional compensation.

Source: BoA ML

Risky assets, like equities, over the long run are expected to have higher absolute returns than “risk-free” assets. Some of this is due to credit risk (risk-free assets in theory have no credit risk) but the main reason is path-risk. Investors are getting compensated for all of that realized volatility when investing in risk assets. When looking at treasuries, this is historically true as well via the concept of term premium. The longer the duration, the greater the mark-to-market price movement on your principal. Credit risk of a 3-month bill and a 30-year bond is assumed to be the same, but historically you get compensated via a “term premium” to hold a 30-year bond for accepting the additional volatility. Realized volatility in treasuries has been elevated for the past 3-years and should cause investors to demand additional compensation for holding longer-dated treasuries.

Source: Cboe

Source: https://www.sifma.org/

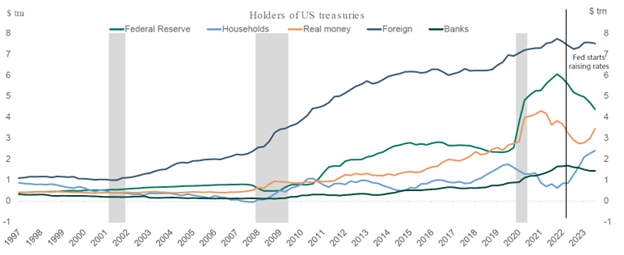

Holders of treasuries have different motivations. Foreigners may be looking to safely deploy reserves received from trade imbalances. Banks may hold to deploy deposits. Insurance and Pensions may hold for liability management. Households generally buy treasuries for safe after-tax absolute returns. Moving from over a decade of ZIRP (zero interest rate policy) to 5% in fed funds logically should attract more absolute return buyers of treasuries, which has absolutely been the case since.

Source: https://www.sifma.org/

Source: https://fred.stlouisfed.org/series/MMMFFAQ027S

Taxable investors sopping up additional supply has a major benefit and a major drawback for the Treasury. The benefit for the Treasury is receiving a significant portion of coupon payments back via tax receipts reducing the true effective interest rate. A drawback, if an after-tax absolute return investor no longer finds treasuries attractive, it both removes a potential buyer of supply AND reduces tax receipts, increasing deficit and thus total supply with less demand.

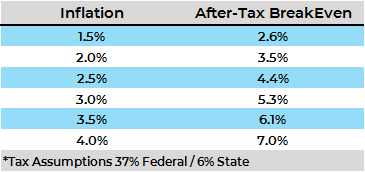

Source: Convexitas Calculations

Assuming the highest federal income tax-rate and the average state income tax rate, the interest rate needed to earn on treasuries to simply tread-water with inflation (real return of zero) is surprisingly high. If you believe in the long-term inflation target of 2%, a taxable investor can breakeven at a 3.5% interest rate. BUT if inflation expectations are 1% higher at 3%, a taxable investor needs to demand ~5.3% to breakeven.

It’s fundamentally difficult to like bonds. Inflation, increased supply, potential issues with future demand, all stand in the way of 2025 being a good year for the “40”. If 2025 has spectacular returns for the “60” like in 2023/24, then the negative real returns for bonds will likely get ignored once again. With equity valuations currently elevated from the 2-year rally, higher discount rates have the potential of causing a problem for risk assets. Equities have duration too, and when valuations are elevated, it’s more material.

Equity Valuations – Higher Yields Can Cause Problems

Fundamental equity investing usually starts with some version of a DCF (Discounted Cash Flow) model. An analyst creates their expectations of cash flows and terminal value into the future for a company, and then discounts those cash flows by the risk-free-rate plus a spread. In order of importance to get the current value of that company is 1. Cash flow/terminal value assumptions 2. Spread demanded to earn over the risk-free rate 3. The risk-free rate. Since rates are the least important factor, it is also why their impact on equity prices is often ignored. Elevated valuations combined with significant moves in rates are generally the periods where the duration of your equity portfolio becomes a point of focus.

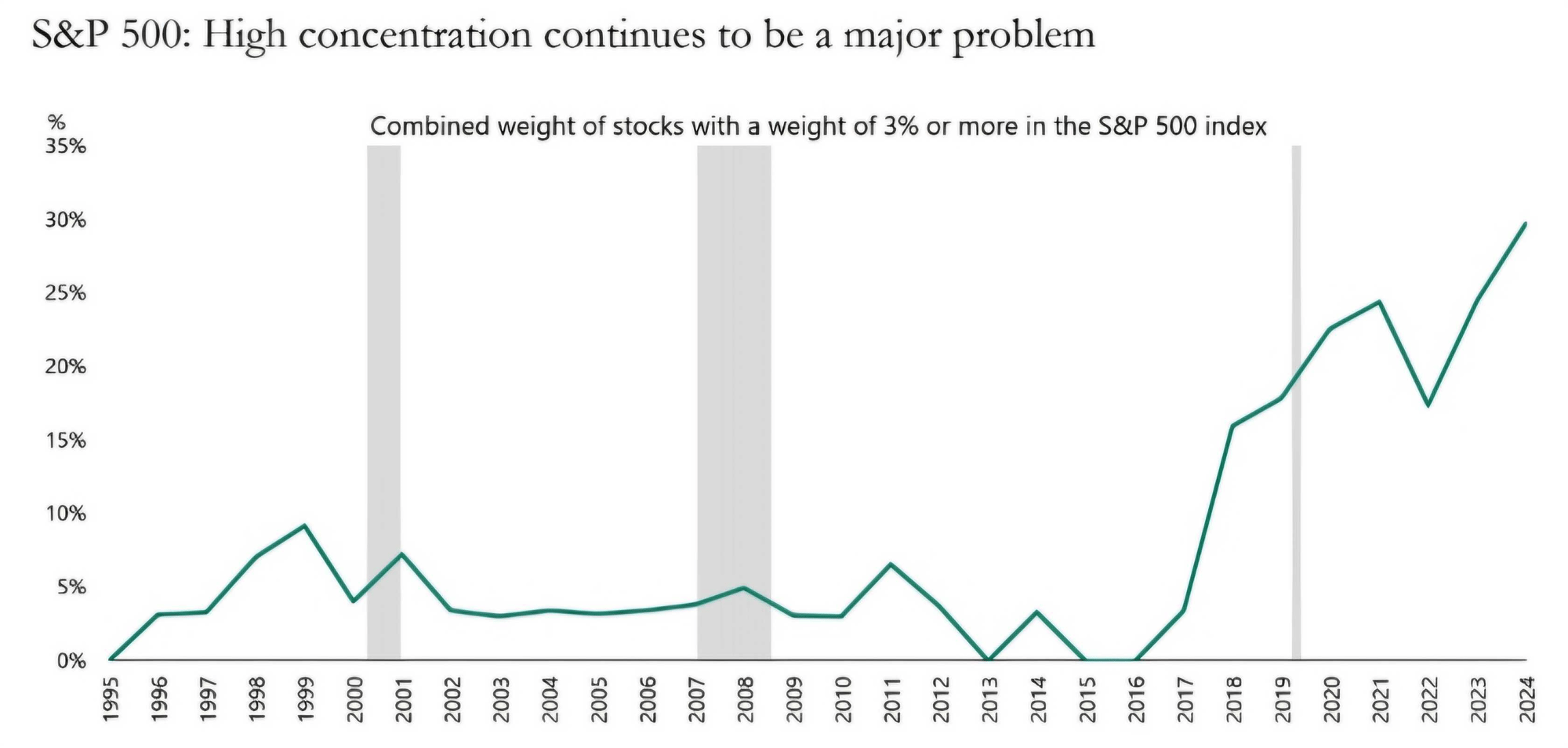

Source: Apollo

Let’s use Apple as an illustration: it is the biggest company in the world and widely owned due to its index weight. The biggest names matter more to your portfolio than most likely any other time in your career. By no means is the point of this example to claim a specific duration for equities. It is meant to be an exercise to show how a move higher in yields has the potential to damage equity valuations.

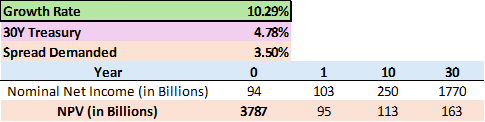

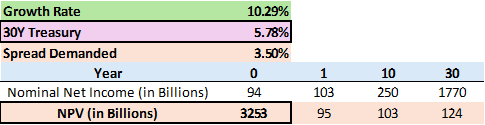

Assumptions in the hyper-simplistic DCF Model:

- Current Value of AAPL is “fact”

- Return investors demand is 3.5% over 30-year treasuries

- Solve for a flat earnings growth rate over 30-years

Source: Convexitas Calculations

With these very limited variables to build a simple DCF Model, the earnings growth rate over the next 30-years is 10.29% per annum to get to the current market cap. Now for the point of this example. If we hold everything else the same BUT 30-year treasury rates move up 100bps to 5.78%, what is the new NPV (net present value) of AAPL?

Source: Convexitas Calculations

The fair value of AAPL with these assumptions would be -14% lower from a discount rate increase of 100bps. Another way to summarize, AAPL has a hypothetical duration of 14-years. Again, the point is not to get to the “right” duration number. Just to highlight a continued selloff (higher yields) in rates could cause significant pressure on equity prices.

Apple’s price history during 2022 suggests this vanilla estimate is in the right ballpark. AAPL in 2022 had a total return of -26.4%. 30-Year treasuries sold off 207bps. Using the same (admittedly not “correct” duration estimate as it does not consider convexity) vanilla duration estimate, AAPL experienced a move that suggested a duration of 13-years in 2022. Equities are long-duration assets. Growth assumptions are absolutely more important than discount rates, but with current valuations, we would expect a further selloff in rates to accelerate the positive correlation between equities and bonds.

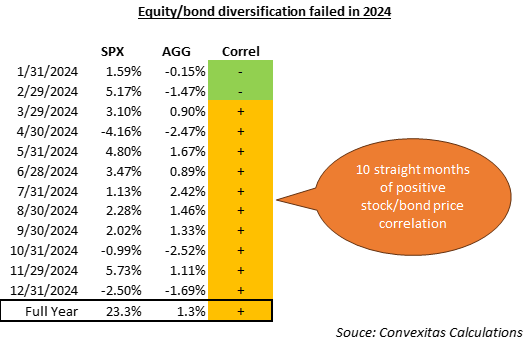

Correlation Killed 60/40 in 2022 – Don’t let 2025 do the Same

US investor benchmark has been the 60/40 portfolio for several decades because it has become easy to access that return stream for low fees, it is sold as a diversified portfolio, and above all else, it has worked very well for current investors lifetimes!

A core principle of the foundation of Convexitas is to help improve portfolio construction through the removal of correlation risk. Relying on historical correlations tends to eventually end in tears. Relying on historical correlations with the addition of leverage tends to end with a no portfolio left to shed a tear over. We just went through 2022 where both stocks and bonds went down significantly. And yet, the standard portfolio still targets the 60/40.

Most investors are surprised by the above chart in that for the majority of history, bond prices and stocks have been positively correlated. That means bonds have NOT served to diversify equities for more than half of market history. Still, a foundational assumption of modern portfolio construction is that bonds hedge your equity risk.

Strikingly, the past 10 months in a row have been positively correlated. For sure that’s a happy outcome when both stocks and bonds are up, but it masks an underlying piece of evidence that the market structure may be shifting to further erode fixed income’s diversification properties, particularly at a time when the direction and momentum of inflation is in question.

Additionally, equity valuations are elevated in a historical context suggesting that equities have more duration than average. High equity valuation increases portfolio interest rate risk. When equity valuation multiples expand quickly, that’s not driven by visibility of near term earnings – its driven by an increased expectation for earnings far into the future – the terminal value part of the discounted cash flow analysis discussed earlier in this note. Those cash flows are especially sensitive to higher rates as they occur far in the future, no different than the duration of long term bonds.

Most client portfolios are near all-time highs, so NOW would be a great time to rethink portfolio construction. Diversification without the reliance on correlation is possible with tools like negatively correlated strategies which may improve the stability of returns.

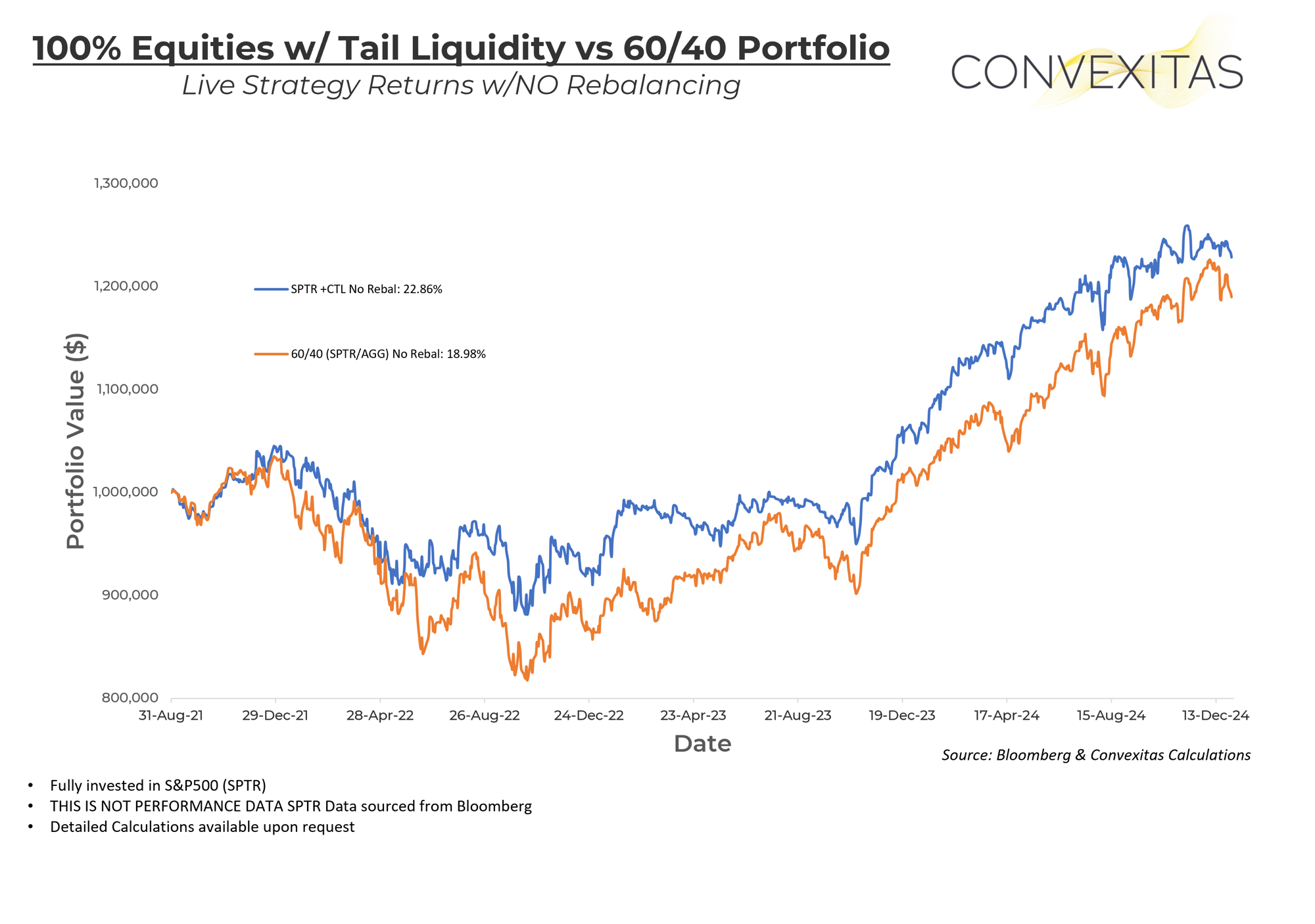

TAIL LIQUIDITY

Most equity diversification allocations rely upon correlations to deliver value to portfolios. We built Tail Liquidity (CTL) to target consistent negatively correlated returns to equities to avoid relying upon correlation assumptions. To achieve this consistency, we rely upon a different lever than most, especially in the volatility space. Our return profile comes from an always-on convexity with respect to directional movement. When the market falls, the strategy has an increasing short market exposure. When markets rise, the strategy has a decreasing short market exposure.

Three Main Value Levers

Tail Liquidity is designed to be an unfunded portfolio construction tool which improves portfolios through three main value levers.

- Take more risk day1 – Tail Liquidity is an unfunded, truly negatively correlated portfolio ballast allowing investors to increase equity & equity-like allocations.

- Redeploy capital during drawdowns – Tail Liquidity proceeds are unencumbered cash directly in client accounts allowing for immediate redeployment during market pullbacks.

- Improve tax efficiency – Tail Liquidity itself is tax efficient, accelerates the potential of tax-loss harvesting, and ensures the portfolio never ossifies.

It Works!

In the past year, we crossed 3-years of live management of the strategy. Without a doubt some periods were better than others, as is usually the case in investing, but the important takeaway is that the three main value levers delivered as expected.

Source: Convexitas Calculations

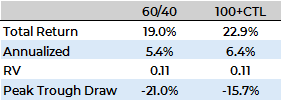

A completely static, buy-and-hold portfolio comparison of 60/40 to 100+CTL resulted in increased annualized returns with slightly less volatility and a ~5% reduction on peak to trough drawdown. Said another way: better, more consistent returns with less downside.

While this illustration rebalances at month end to avoid bias, we recommend that clients initiate these rebalances based on actual market movement rather than by fixed calendar periods.

A recent real-life example of the value which can be created from risk vs timing-based rebalancing was August 2024. Tail Liquidity provided enough unencumbered cash the first week of August from the Yen carry trade unwind for most clients to redeploy capital, yet for the calendar month of August, the S&P500 was UP 2.4%. A calendar period based rebalance would have missed this opportunity. Opportunistic rebalancing is a prime example of why we deliver the strategy in SMA format: immediate access to liquidity is an important value for a portfolio tool.

The tax efficiency of utilizing Tail Liquidity as a portfolio construction tool is maximized through rebalancing and continual tax-loss harvesting (TLH). A full discussion of the interaction between opportunistic rebalancing of Tail Liquidity’s proceeds and tax loss harvesting is beyond the scope of this note, but if you are interested in more on this topic please contact us.

With all of that said, looking at a static return stream with some basic tax rate assumptions is simple, and the results are significant. The majority of fixed income holdings are taxed at the income-tax rate making these distributions fairly tax inefficient. Additionally, the 60/40 portfolio does not have a consistent source to create losses in a static environment as its “long only”. Tail Liquidity creates a “long/short portfolio” resulting in a source of losses in all market environments. A combination of more tax efficient longs and the ability to source losses in all market environments dramatically improves that tax efficiency of a portfolio even with a static implementation.

Tail Liquidity has been able to provide a positive experience for clients. The three main value levers to improve portfolio construction have delivered reduced volatility, improved pre-tax returns, and greatly improved after-tax results in comparison to the 60/40 portfolio.

Q4 2024 Commentary

Risk adjusted returns logged a second straight blockbuster year with greater than 25% returns on low realized volatility. Very few periods in history have provided such returns with low risk just by holding the index.

The election absolutely dominated the quarter. Realized volatility (actual market movement) was ~10 for the month leading into the “event” and yet, implied volatility (the price of options) was in the mid-20s. This elevated option pricing with limited movement is a very difficult environment for the strategy. Making things even more difficult, the market trended higher. Once the event rolled off the calendar volatility cratered, resulting in a November that generated the entire underperformance for 2024. The decision which would have yielded the best results would have been to dramatically reduce exposure into the election, but that was of course unknowable at the time and would have left the strategy very under positioned to capture our downside targets in this somewhat extreme situation. It is a delicate balance to deliver downside protection goals while acknowledging the elevated pricing of known events: we acknowledge this was not our best performance, believe we learned some lessons about sizing for known events and believe we can improve going forward.

Starting 2025, volatility looks far more in line with historical norms. The year ahead appears to be ripe with potential events which do not have a specific date on the calendar- the first day of Jan alone included two 1% intraday swings. Our risk-driven active management aims to take advantage of the potential sneezes from surprise headlines in the year to come.

The ability to rebalance and acquire more assets in 2022/23 has allowed clients to continue to improve returns from both the accumulation of additional assets during draws and accelerated tax loss harvesting, while long only diversification continued to provide very little diversification:

- We believe relying on correlations is a major cause of wealth destruction and is why we built Tail Liquidity. You don’t have to rely upon basis to bonds, or even equity implied volatility.

- Tail Liquidity’s goal in isolation is to capture 50% of the downside in markets in exchange for giving up 20% of the upside. Additionally, with separate account implementation, the strategy is collateralized by existing assets without disturbing the tax basis of those assets.

- Unencumbered cash liquidity provided by Tail Liquidity during drawdowns allows for opportunistic reinvestment and/or serving distributions without selling assets.

- Negatively correlated overlay increases portfolio dispersion and reinvestment increases tax lots, accelerating tax-loss harvesting potential.

The goal of Tail Liquidity is to allow investors to take more equity risk day one and redeploy capital during drawdowns. Investors that would have chosen to use Tail Liquidity as their portfolio diversifier instead of fixed income could have experienced higher portfolio returns, while experiencing less of a drawdown during 2022.

To round out our discussion of diversification and 60/40 portfolio comparisons, Tail Liquidity is a clear winner due to its more predictable negative correlation to equities than fixed income of late.

Enhanced Semiconductors

A focus on artificial intelligence and processor innovation drove semiconductor sector returns over the past two years. These chips power not only AI’s sophisticated models, but nearly every aspect of modern life. The semiconductor industry's dynamism and constant evolution present both opportunities and inherent risks. Convexitas’ Enhanced Semis strategy offers a unique way to access accelerated upside while maintaining ETF-like risk on the downside.

CES was created as part of our founding philosophy for delivering positively convex strategies in a relative value framework for the wealth channel. That means we start from an edge in the options pricing – think of it like value investing, but with option prices themselves rather than value from the stock’s fundamentals. Then we utilize this edge in options to construct a strategy with simple transparent goals.

- Greater than 1:1 upside: CES should achieve better returns than an ETF allocation on the way up.

- 1:1 downside: CES should achieve similar returns to an ETF allocation on the way down.

- Neutral to positive carry: CES should achieve zero to slightly positive returns when the Sector is unchanged.

- Client earns additional returns on collateral as the above profile is delivered unfunded via a Separately Managed Account (SMA).

If your practice and/or clients want to allocate to the semiconductors sector, this strategy with these easy to communicate goals could be the best means of directing an allocation to the semi sector.

So has the strategy consistently delivered these goals?

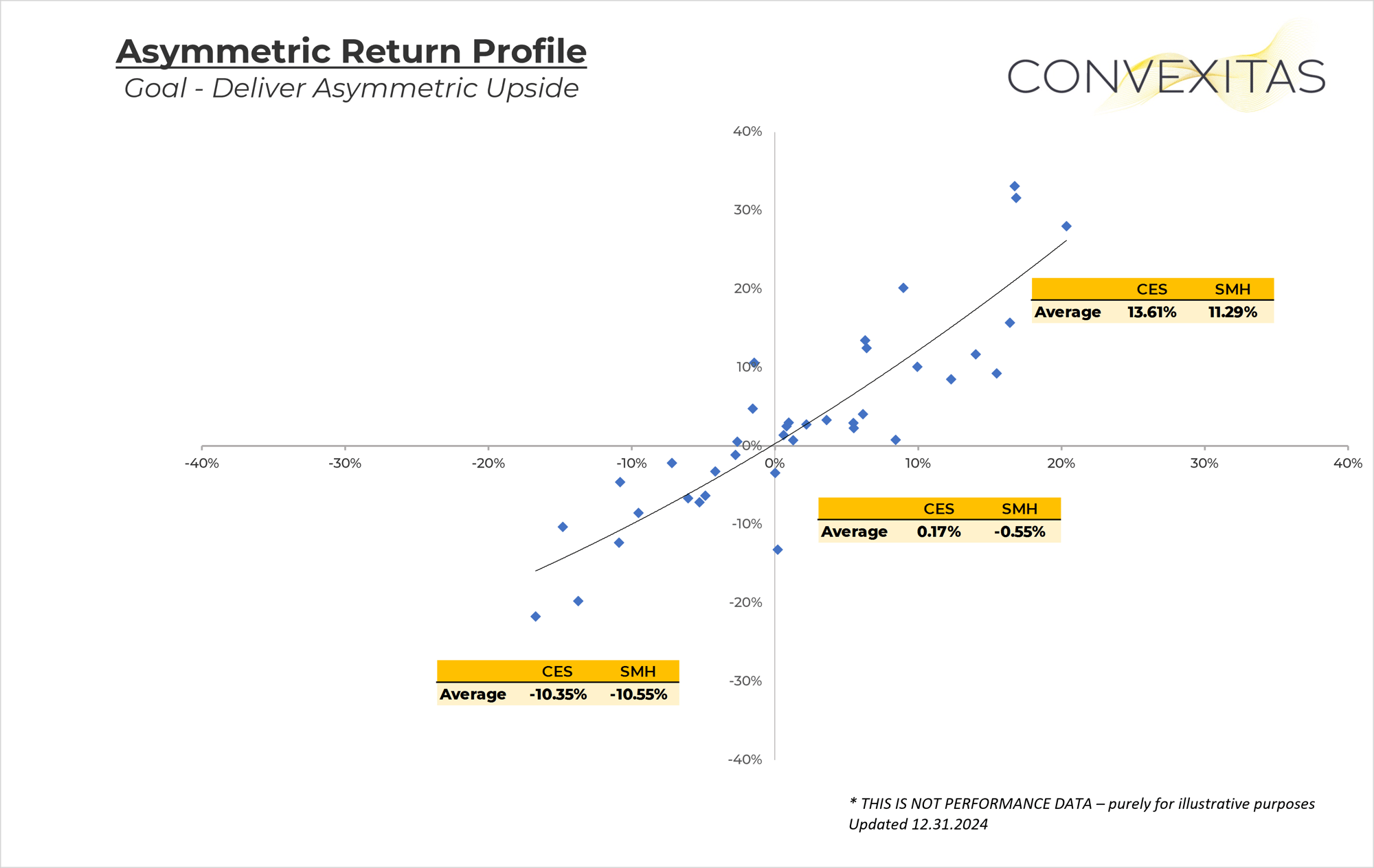

Breaking up performance into monthly increments, the consistency is well illustrated. From the left/lower table to right/upper table:

- Months when the Semis Sector was down 5% or more, Convexitas Enhanced Semis (CES) experienced almost exactly 1:1 downside.

- Months when the Semis Sector returned less than +/- 5%, CES experienced positive carry.

- Months when the Semis Sector was up 5% or more, CES experienced better than 1:1 upside.

CES now has over three years of live track record and returns has been very much in line with the stated goals. Even though three years is not a significant amount of time, we have experienced very different market environments to stress the resiliency of the strategy.

- 2022 was a down year where the strategy outperformed due to active rebalancing.

- 2023 was a highly correlated rally where the core edge delivered significant outperformance.

- 2024 had a significant dispersion in returns during a significant rally, challenging the core edge in strategy.

Semis were highly rangebound during the last quarter of 2024, and the sector ended effectively unchanged. Going into the quarter, implied volatility had extremely different expectations with SMH volatility in the high 30s to low 40s. The actual realized volatility turned out to be closer to 20. The event calendar included both the election and NVDA earnings whichn anchored volatility at a much higher level than the index achieved throughout much of the quarter.

Convexitas Enhanced Semiconductors (CES) is a short-dispersion strategy. This means our edge is created from index volatility being cheap relative to single name volatility due to a mispricing in correlation across sector constituents. Said another way, the sector tends to move in the same direction much more than what is priced into the index options. For most of 2024, this was not the case and was a problematic environment for our core edge.

Source: Convexitas Calculations

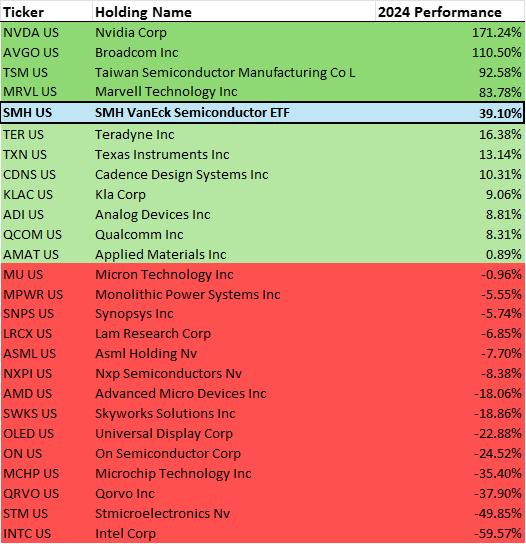

The semiconductor sector had spectacular performance in 2024 and significantly outperformed the S&P500 and NASDAQ. When looking at the individual names, it tells a very different story. Only 4 of the 25 names outperformed the index. More amazingly, 14 of the 25 names were DOWN with the index up 39%. This is a lot of return dispersion and a detriment to a strategy that is levered to the stocks being correlated on the upside.

An index can only achieve this type of outcome when the heaviest weighted names drive most of the performance- exactly what occured in 2024. At the end of 2023, NVDA / TSM / AVGO were in the Top 5 sector holdings. After the 2024 returns, they ARE the Top 3 holdings in the sector accounting for almost half of the index.

Concentration of performance is problematic for a short dispersion strategy. The strategy aims to achieve accelerated upside by selling single stock puts that we view as expensive relative to SMH sector etf calls, allowing the strategy to buy more upside calls than it theoretically should be possible in the absence of the relative value mispricing. So when the majority of names in the sector go down but the sector etf is higher due to the performance of only a small group of names, enough short put positions of the strategy can lose money even though the sector is higher. This is THE risk in a short dispersion strategy and 2024 was a dramatic year of dispersion for the semis sector.

Even with a difficult environment for the strategy, CES has achieved ~15% annualized outperformance and almost 32% annualized absolute performance since inception. We strongly believe our core edge remains intact even after an outlier year. If your practice or your clients are interested in allocating to Semis or AI, CES is a great tool due to leveraging the structure imbalances in options markets during each of during down / neutral / up markets.

FIRM UPDATES

MEDIA APPEARANCES

Low Vol / High Returns, will 2025 be different? – The Derivative Podcast: Listen Here

US equity markets are having a spectacular year with low realized volatility. Much of the general narrative for 2024 has been focused on risks; geopolitical, the election, concentration of returns… take your pick. When in reality, equity markets are having some the the best risk-adjusted AND absolute returns of our careers. Higher perceived risk than reality can be helpful for markets to “climb the wall of worry”. When looking at current allocations / sentiment, I don’t think anyone is worried. Sentiment surveys are extremely bullish on both stocks and bonds. Equity allocations are at all-time peaks. Higher beta assets have been screaming. Even Jason’s father / father-in-law are buying Tritoons! (we had to google during the pod to learn that its a boat). With high prices / high valuations / bullish positioning and sentiment, what is in store for 2025? Also, the best burger is Minetta Tavern Black Label!

Don’t Forget Taxes! Take-Home Yields of Treasuries – Schwab Network Market On Close: Listen Here

Flows and Fundamentals. Higher rates can create a problem for equities in two main camps.

-

- Flows: Investors may adjust capital allocations away from equities into fixed income as fixed income compensation increases. This is likely the first wave of pressure on equities.

-

- Fundamentals: While a bit less to do with a cause for a correction and more so there is the “floor” in a correction, equity valuations are the current value of future cash-flows. If rates are higher, the present value of the cash-flows is less. Current equity valuations are elevated by historical standards. If we were to get a correction in risk assets while rates sell off (higher yields) the fundamental floor in equities may be a good bit away from current prices.

What Gamma Doesn’t Tell you – Schwab Gamma On Episode 8: Listen Here

In a much different type of media appearance, Devin appeared on Schwab Network’s limited series “Gamma On” to discuss the impacts of derivative market making and hedging on the underlying stock market. In this unique episode, Devin lays out how derivative trading and hedging probably is and more often, is not, effecting the overall movement of markets.

Rates back in focus for 2025 – LIVE From Schwab Impact: Listen Here

Rates! NOT necessarily inflation. The most important market for 2025 is longer maturity treasuries. Institutional derisking has already taken place, so further demand will be limited. Taxable investors have been taking down a lot of supply, but after a couple of tax seasons, after-tax yields of only 2.5-3.5% may cause demand to diminish. Supply, supply, and more supply is coming down the pipe with 6-7% of GDP deficits. Long-end treasury volatility remains high. All of these factors can cause rates to sell off (higher yields) even without a change in the path of inflation.

Will Stano Joins as Director of Business Development

Convexitas welcomes Will Stano in the role of Director – Business Development on January 13!

Will brings more than a decade of sales and marketing experience to Convexitas, where he was most recently marketing derivative treasury solutions to regional banks. He will be leading our sales and marketing efforts, primarily focused on developing new advisor and platform relationships.

Will is available at will.stano@convexitas.com or (312) 761-1505.

follow us for timely commentary

Follow Convexitas on LinkedIn to see these in real time, along with useful bite-sized clips from of our favorite parts of these interviews, like below!

Thanks!

If you are a current client, thank you for your confidence, and we look forward to doing our best to replicate our success so far many times forward.

If you are a prospective client, we’re going to continue to work to earn your trust for that first allocation. Our primary focus is for all our strategies to simply do what they say on the tin while providing an easy service experience.

Sincerely,

Zed, Devin, and Brian

want to talk?

Please leave your info for us to reach out or you can schedule a meeting now!

Let us contact you...

Ready tO Get Started?

Contact Convextias today to learn how you can increase your liquidity, react faster to opportunities, and confidently meet your financial commitments.

Introductory Information. This document (i) was prepared by Convexitas LLC (“Convexitas”) for the exclusive use of the intended recipient (the “Recipient”); (ii) is confidential and may not be distributed (except to your financial, tax or legal advisers) or copied without Convexitas’ permission, and must be returned or destroyed upon Convexitas’ request; (iv) is not an advertisement, is for informational purposes only, does not purport to be full or complete and may not be relied upon; (v) does not constitute an offer to sell, or solicitation of an offer to buy, any securities or investment services, including in any investment vehicle, account or other product (each, a “Product”) implementing Convexitas’ strategy (the “Strategy”). An offer to buy an interest in a Product may only be made by and is subject to the applicable investment management agreement, or other offering or subscription documentation (collectively, “Governing Documents”) and only in jurisdictions in which such an offer would be lawful. Any decision to invest with Convexitas should be made only after conducting such inquiries and investigations as the Recipient deems necessary, and consulting with the Recipient’s financial, tax and legal advisers in order to make an independent determination of the suitability, risks and merits of making an investment. No regulatory or self-regulatory authority has passed upon or endorsed this presentation, the merits of the Strategy or an investment with Convexitas.

Risk of Loss. Convexitas’ investment products, like all investments, involve the risk of loss. Investment products may be speculative and are designed only for sophisticated investors who are able to sustain the loss of their investment. Accordingly, such investment products are not suitable for all investors. The products sponsored and managed by Convexitas are not subject to the same or similar regulatory requirements as mutual funds or other more regulated collective investment vehicles. An investment in the Strategy is subject to complete loss.

Forward-Looking Statements. Certain information contained in this presentation constitutes “forward-looking statements,” which can be identified by the use of forward-looking terminology such as “may,” “will,” “should,” “expect,” “anticipate,” “project,” “estimate,” “intend,” “target,” “continue,” or “believe” or the negatives thereof or other variations thereon or other comparable terminology. Due to various risks and uncertainties, including those described in this presentations, actual operations, implementation or performance of the Strategy, or other relevant events, may differ materially from those reflected or contemplated in such forward-looking statements. No representation or warranty is made as to the Strategy’s future performance.

Hypothetical Performance: Hypothetical performance results have many inherent limitations, some of which are described below. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk in actual trading. For example, the ability to withstand losses or adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results. There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all of which can adversely affect actual trading results.

Past performance is not necessarily indicative of future results.